Low & Bonar处置农用纺织品业务

礼宾:Low & Bonar

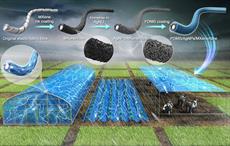

Low &在利基工业市场处于领先地位的国际性能材料集团博纳尔(Bonar)已同意以610万英镑的现金对价,将其农用纺织品业务出售给瑞典工业集团杜洛克(Duroc)旗下的IFG Exelto。188金宝搏手机版网址IFG是一家领先的聚丙烯、聚乙烯、聚酰胺纤维和长丝纱制造商。此次处置将包括出售集团在欧洲和美国的农用纺织品业务的主要资产,包括集团在比利时Lokeren的工厂及其库存,对价将在完成时以现金支付,但须遵守正常的营运资本机制。188金宝搏手机版网址在利基工业市场处于领先地位的国际性能材料集团Low & Bonar已同意以610万英镑的现金对价将其农用纺织品业务出售给瑞典工业集团杜洛克(Duroc)旗下的IFG Exelto。188金宝搏手机版网址IFG是一家领先的聚丙烯、聚乙烯、聚酰胺纤维和长丝纱制造商

The disposal is expected to complete no later than 30 September 2017, subject to the fulfilment of a number of conditions, including the satisfactory completion of an information and consultation process with the employees affected by the disposal. Under the terms of the agreement, all employees will transfer with the business and no redundancies are anticipated.

The disposal is in line with management’s stated aim of improving operating margins in all its global business units. The agro-textiles business is profitable, with an established market position and an excellent customer base but requires investment to take it through its next stage of development in improving its efficiency and performance. The business has scope to grow with the support of IFG, but is non-core to Low & Bonar’s future strategic aims.

The agro-textile business delivered a turnover of £19.9 million in year to 30 November 2016 and the disposal will generate an anticipated £10 million non-recurring loss in the second half of the year. The net proceeds of the disposal will be used to reduce the group’s net borrowings, providing flexibility and headroom to fund more profitable and cash-generative opportunities. It is anticipated that the disposal will be marginally dilutive to the group’s earnings per share in the current financial year but improve the quality of business and group margins.

Brett Simpson, group chief executive, commented: “Our stated strategy is to actively manage our portfolio of businesses, to increase sustainable cash generation and invest in areas where we can achieve a clear competitive advantage. This disposal will enable us to reduce complexity and focus our efforts on those areas of our business where we can offer our customers a differentiated value proposition and build long-lasting customer relationships.” (SV)

Fibre2Fashion News Desk – India

">